As investors across the globe search for stability and income, it is becoming more common to see investors shift capital from fixed income securities into the equity market. It should be no surprise that the shift away from the bond market and into equities is heightening the risk profile of many portfolios by reducing the benefits of diversification. Rather than completely abandoning bonds and other fixed income assets, another option could be to consider corporate bonds through various exchange-traded funds. In the article below, we’ll take a look at the patterns and try to determine where prices are headed from here.

SPDR Barclays Short Term Corporate Bond ETF

One of the most popular exchange-traded funds used by investors for gaining exposure to corporate bonds is the SPDR Barclays Short Term Corporate Bond ETF (SCPB). For those new to this type of investing, the fund’s managers seek to provide investment results that, before fees and expenses, correspond to the price and yield performance of the Barclays U.S. 1-3 Year Corporate Bond Index. Taking a look at the chart below, you can see that the fund has been trading along a key ascending trendline, and the bulls have propped up the price on each attempted pullback for most of 2016. Given the proximity of the support, active traders will likely look to set their stop-loss orders below the trendline or the 50-day moving average, which are both trading near $30.71. (For more, see: Top 5 Bond ETFs for 2016.)

iShares iBoxx High Yield Corporate Bond Fund

Another popular ETF used by traders looking for alternatives to dividend paying stocks is the iShares iBoxx High Yield Corporate Bond Fund. The managers of this ETF seek to provide investors with exposure to a broad range of U.S. high yield corporate bonds for a reasonable expense ratio of 0.50%. So far this year the fund has moved higher by 12.21% and based on the chart below, it looks like the momentum could continue. Notice how the ascending trendline and the 50-day moving average have helped act as strong levels of support. Based on technical analysis, this type of behavior is expected to continue and many traders will maintain this bullish outlook until the price closes below $85.14.

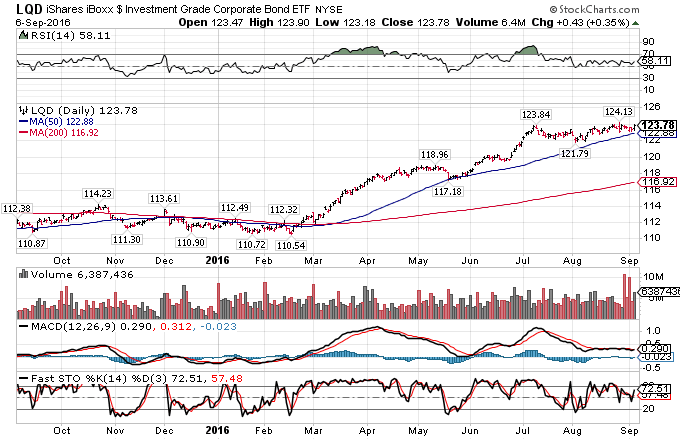

iShares iBoxx $ Investment Grade Corporate Bond ETF

For investors who would like to reduce the risk of their bond holdings more than what is offered through the funds mentioned above, one of the most popular options would be the iShares iBoxx $ Investment Grade Corporate Bond ETF (LQD). This fund offers investors access to more than 1000 high-quality corporate bonds in one holding and has total net assets of nearly $33 billion. Fundamentally, the low expense ratio of 0.15% also makes this fund appealing to all types of investors and based on the chart below it is trading within one of the strongest uptrends found anywhere in the public markets. Active traders would likely maintain a bullish outlook on LQD until the price closes below $122.88.

The Bottom Line

The global interest rate environment and thirst for yield have led many investors to shift capital from the fixed income market and into equities. Based on the charts of the bond funds shown below, rather than moving entirely into stocks it could be time to add some corporate bonds to your portfolio.