Europe’s asset-backed securities market (ABS) is going underground.

Having been thrust into the spotlight after the financial crisis as regulators blamed the products and the bankers that structured them for causing the crash by obscuring risks, the ABS market is retreating further into the shadows.

Private bilateral sales of the bonds, which are typically backed by collateral such as car loans or mortgages, now outstrip public sales to investors, according to Bank of America Corp. analysts led by Alexander Batchvarov.

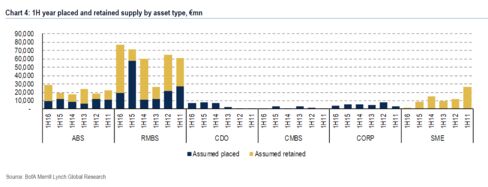

So-called retained transactions, which are kept on banks’ balance sheets, rose to 78 billion euros ($87 billion) in the first six months of the year, which is more than double the 30 billion euros sold in the same period of 2015, according to Bank of America data. For investors in the public market, new-issue supply totalled just 41 billion euros, or roughly half the volume recorded a year earlier.

Instead of using securitization — the process by which such ABS are created — to provide investors with new assets, banks are using the technique to manage risks and offload assets in private transactions that are typically unrated and where transaction data is often not available.

While many retained deals are destined for use as collateral at the European Central Bank’s liquidity programs, securitization of whole loan portfolios including non-performing loans, is a source of growth for retained deals, according to Bank of America.

Synthetic securitizations, in which credit derivatives are used to transfer risk, are also said to be growing in favor as banks seek to bolster their balance sheets — and even as regulators push back against use of such “regulatory capital” trades.

“Discussions with market participants suggest that the volume may be (much) larger,” Batchvarov wrote. “The revival of synthetic securitisations speak[s] to the need of the banks to manage their capital and credit risk of their balance sheet, but apparently this is now done through bilateral transactions, mostly not rated, and rarely seen.”

SOURCE: Bloomberg