The Forgotten Asset Class?

Commodities as an asset class are frequently overlooked by investors. Many investors and financial professionals view commodities as too speculative or too volatile, and they’re right. Investing in commodities is not for the faint of heart. But as a means of diversification within a long-term investment portfolio, commodities should certainly be considered.

To balance the risks and potential rewards of commodities, the rule to keep in mind is that commodities should only ever be between 5-10% of an investor’s overall portfolio. Any more than that, and your portfolio may be too speculatively weighted or volatile. Any less than that and you’re missing an opportunity to further diversify your portfolio and potentially augment returns.

What Makes Commodities Move?

Commodities are generally considered cyclical in nature, with commodity demand and prices generally rising when economic growth is good, and vice versa when the economic outlook turns soft. Sure, there are short-term periods of volatility, up and down, in individual commodities due to droughts/floods, production disruptions, and other one-offs, but they’re the exception over the long-run.

As a result, commodity prices can experience extended price trends, both rising and falling, based on longer-term economic cycles. Even more importantly, commodity prices can be leading indicators to larger economic cycles, as they’re very sensitive to changes in demand and are the leading edge of production. As a part of a portfolio, then, investor would be wise to undertake a bit of market timing, adding commodities after extended declines, and exiting commodities after extended gains.

In relation to other asset classes, commodities are positively correlated to stocks, as you might suspect given the cyclical nature of stocks and the overall economy. But that positive relationship, meaning they tend to move in the same direction, is at a relatively low level of about only 35% since 2000. Compared to bonds, commodities are negatively correlated, meaning they tend to move opposite to each other, but also at extremely low levels of correlation. These low levels of correlation are what make commodities a good choice to obtain diversification.

Commodities have a negative correlation to the value of the US dollar, and at more relevant levels (around -45%) since 2000. That means a strengthening US dollar will tend to weigh on commodities, while a weakening US dollar will tend to support commodity prices. In terms of inflation, commodity prices generally track inflation trends, as they are an underlying input to inflation indexes.

How to Invest in Commodities

The most obvious way to invest in commodities is to buy commodity futures contracts. But that entails multiple futures transactions to build a diversified portfolio of commodities, raising costs and increasing complexity and risk.

For most individual investors, the simplest and least expensive way to include commodities in their portfolio is through broad-based commodity index ETFs. (Please see an important ETF risk disclaimer at the bottom.) By investing in an index ETF, you typically gain exposure to the full range of the commodity complex (agriculture, energy, metals and materials), depending on the index the ETF follows. That allows you to take advantage of the broad cyclical change in commodities overall, and avoid the hazards of picking an individual commodity, such as oil or soybeans. A few widely available broad-based commodity index ETF’s to consider are DBC, GSG, and DJP. (Learn more about ETFs.)

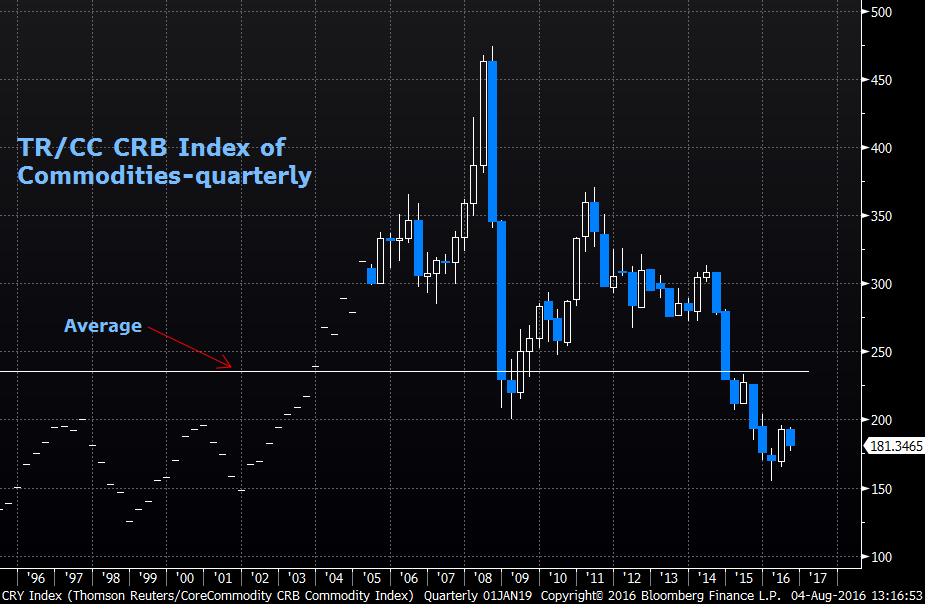

Source: Bloomberg; DriveWealth

Looking at a long-term history of commodity prices in the chart above, several long-term trends are evident, up and down. (The TR/CC CRB Commodity index is an index based on the futures prices of 19 different commodities and is presented as a proxy for broad-commodity indexes. The ETFs mentioned earlier may use different commodity indexes than the TR/CC CRB index.)

From about 2001 to 2008, there is a long-term trend higher, as global growth was solid and commodity demand from China was insatiable. The Great Financial Crisis of 2008-09 (GFC) put an abrupt end to that trend, but also quickly stabilized once markets recovered and stimulus measures in response to the GFC kicked in (mid-2009 to late-2011). As those stimulus measures faded-out in late 2011, commodities weakened as well. The most recent phase of commodity weakness (2014-2016) stems from multiple factors: Sluggish global growth, lower Chinese demand, widespread disinflation, and a strengthening US dollar all combined to hurt commodities.

Looking at the big picture again, it’s clear the commodities index as represented by the TR/CC CRB Index is near the lowest levels in over two decades. (Some individual commodities, such as gold, may actually be closer to their historical highs; the index is used as a proxy for all commodities lumped together.) While there’s no guarantee they won’t go lower, if you don’t have any exposure to commodities, now might be a good time to consider allocating a small portion of your portfolio to the commodity space. If economic activity picks up in the years ahead as the long-term effects of the GFC finally fade, or inflation begins to emerge, an investment in commodities might offer potentially enhanced returns.

SOURCE: Benzinga