by Andrew Hecht

A dividend paying equity is usually not a candidate for huge price appreciation and a growth stock rarely offers a juicy yield. It is rare when a market sector offers both the opportunity for capital growth and yield at the same time. Often stocks offer one or the other.

It is also a rare occasion when an author gets the opportunity to write an article or work on a project with their favorite editor. Any of you authors out there know that it is our editors that make us look good and help us to achieve our potential. I am fortunate to have found such an editor at Seeking Alpha. Robyn Conti has generously agreed to author this piece together with me. Robyn’s talents transcend mine, and while I am a prolific contributor to the site, it is Robyn that always makes me look as good as possible – and that is not an easy job.

Robyn is a rare commodity and raw materials are finite assets. This piece focuses on an opportunity that is as rare as a complimentary, competent and talented editor and writer – all of those attributes describe Ms. Conti. As you may surmise, Robyn did not write this intro to the piece and will probably object to it as she is also humble, but she did a great deal of work and analysis on the piece for which I am grateful. The chance for both growth and yield in a sector that might be staring us in the face at this very moment is as just as rare as Robyn, and I have spent the last couple of days researching, debating and discussing the current state of the commodities market with her. We have come up with some compelling conclusions to share with you.

Commodities markets have bottomed

Raw material prices peaked in 2011/2012 with many commodities rising to all-time highs. Over the next almost five years, this asset class made lower highs and lower lows as it entered a cyclical bear market. During the fourth quarter of 2015 and first quarter of 2016, many commodities fell to multi-year lows, but in the middle of February, the market turned around dramatically. One of the most dramatic gains came from a shipping metric, the Baltic Dry Index.

The BDI is a measure of shipping rates for dry bulk cargos of raw materials. On February 10, it hit all-time lows at 290 and by April 27 it had increased to 715 – an increase of over 146% in just nine weeks. As of last Friday, the index was at the 634 level, still over 118% higher than the mid-February lows. This index is an excellent measure of global shipping activity and its rise from the lows is a good indication that demand for commodities has picked up over recent months.

Each commodity has its own idiosyncratic supply and demand characteristics that determine the path of least resistance for prices. However, as an asset class, we have witnessed some dramatic changes that have altered the bear market conditions that have existed over the past five years. The most closely followed commodity in the world, crude oil, is a perfect example.

As the weekly chart illustrates, the price of the energy commodity has rallied from lows of $26.05 per barrel on February 11 to highs of $48.95 last week – an increase of an incredible 87.9% in three months and one week.

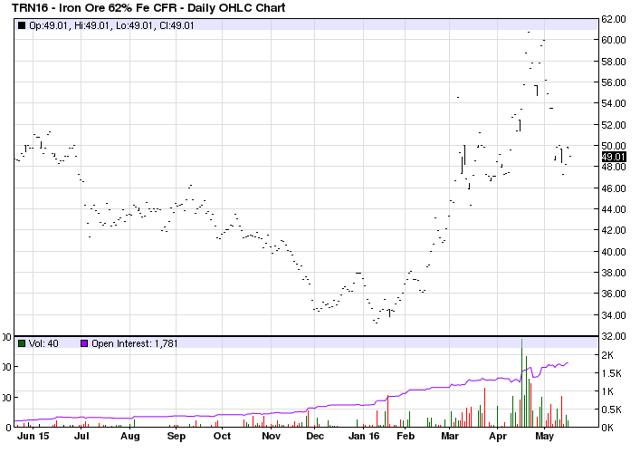

The price of iron ore, the key ingredient in steel, rose from almost $33 per ton in January to over $60 per ton in April and was trading just under the $50 level last week.

Copper appreciated from lows of $1.9355 in January to over $2.30 per pound in March; last week it was trading around the $2.06 level.

Gold has moved from lows of $1,046 last December to highs of $1,306 in early May. Last week the yellow metal was at the $1,253 level.

Soybean prices have exploded from $8.49 per bushel in late February to highs of $10.88 last week.

Sugar has increased from 10.13 cents per pound last August to highs of over 17 cents last week. There are many more examples of commodities that have moved higher over recent weeks and months. The raw material asset class has had a very good year so far in 2016.

Commodities are the most volatile asset class of all and they are highly sensitive to moves in the U.S. dollar. The dollar is the reserve currency of the world and it is the benchmark pricing mechanism for virtually all commodities. Strength in the dollar in 2014 and 2015 helped push commodities to multi-year lows, and the recent decline in the U.S. currency is partially responsible for the rebound in raw material prices. Right now the dollar is above a crucial level on a technical basis.

As the monthly chart of the U.S. dollar index highlights, the greenback has dropped from the 100 level in late 2015 to lows of 91.88 on May 3. However, the dollar bounced off those lows and is now over the 95 level on the active month dollar index futures contract. One important thing to note about the currency is that if the dollar closes the month of May above the 95.21 level on the dollar index, it will mark a bullish key reversal trading pattern for the currency. The dollar made a new low this month and 95.21 was the April high. A close above that level could cause a follow through rally in the dollar, causing commodity prices to retreat from current levels.

Given the volatile nature of commodity prices, they tend to overshoot on the upside during rallies and on the downside during dips. This tends to be the case when it comes to short, medium and even long-term trends.

Therefore, the lows we witnessed in late 2015 and early 2016 were likely an over-extension of the long-term bear market. We view the bounce from those lows and upside trajectory of many commodity prices as a significant shift in momentum and direction. This does not mean they cannot retreat from current levels, but it does mean that a return to lows is unlikely.

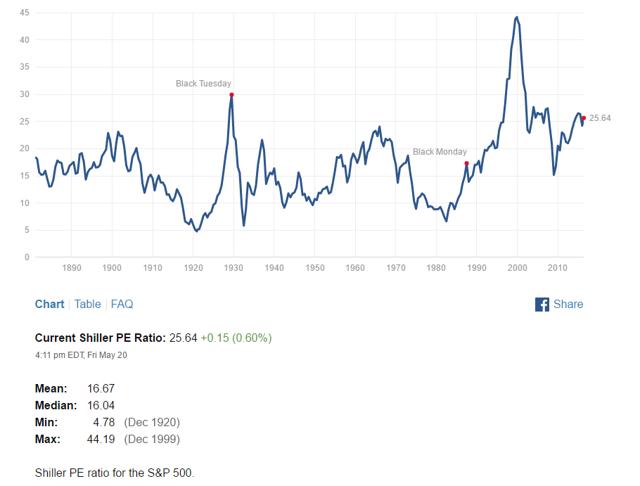

The bottom line is that the optimal strategy for trading or investing commodities from 2011 through 2015 was to initiate trades by selling on strength and covering short positions on price dips or at new lows. Since February, that has changed and it now appears that price retreats will offer the opportunity for investors and traders to initiate long positions in commodities and raw material related vehicles. The beauty of the asset class is that when it comes to commodity-related equities, they continue to suffer from a bear market hangover, which means they remain cheap relative to the rest of the stock market that is very expensive these days.

The CAPE index as of last Friday stood at 25.64 times earnings – the long-term average is around 16 times earnings. There are some jewels out there in the world of commodity equities that are trading at P/E levels lower than the long-term average and also pay a dividend to boot.

A low-risk approach – Agriculture

Agriculture-based equities have been beaten with a stick over recent years. Three straight years of bumper crops of soybeans, corn, wheat and other grains and soft commodities have caused prices to swoon. However, the demand side of the equation in this volatile commodity sector is one of the most compelling simply because people need to eat and population keeps growing. Arable land for growing crops is a finite resource and the global population stands at over 7.32 billion people, and each second, there are 2.5-3 more people on the planet. This is a recipe for increasing demand each year. Additionally, a drought in 2011/2012 across the fertile plains of the United States and weather issues in other regions of the world caused the prices of corn and beans to rise to all-time highs. Wheat rose to the highest price since the global drought of 2008 and other agricultural commodities traded to highs – sugar was 36 cents per pound in 2011 and cotton, which current trades for around 60 cents per pound, rose to an all-time high of $2.27 per pound.

The prices of all agricultural commodities had dropped to levels that were close to production cost. However, recently we have seen an improvement in prices because of drought conditions in Brazil and floods in Argentina. The increase in global demand can be seen when looking at where the three major grain prices were back in 2000. Soybeans were at $4.61, corn at $2.045 and wheat was trading $2.49 per bushel on the first day of the new millennium. While prices appear low now, compared to where they were back in 2011/2012 – demand has taken them much higher than levels seen 16 years ago. The base price and production cost for all agricultural commodities has increased due to exponential demographic factors. Therefore, we believe that this sector is ripe for a rally and suggest three agricultural stocks that are cheap and pay a handsome dividend.

Potash (NYSE:POT) was trading at $16.53 per share last week. The company is a major producer of fertilizers and related industrial and feed products around the world. Agricultural crops need fertilizers to thrive and the market is growing with the population. POT has a P/E ratio of 14.16 times earnings and pays a dividend of 6.04%. The stock traded in a range between $2.33 per share in March 2000 and $80.54 in June 2008. POT is a cheap agriculturally-related stock and it pays a juicy dividend. It is a beautiful thing to get paid well for waiting for capital growth.

Archer Daniels Midland (NYSE:ADM) is one of the most respected and successful agricultural processing companies in the world. ADM procures stores, transports, processes and merchandises agricultural commodities. The company is an active crusher of soybeans into soybean meal and oil and it processes corn into ethanol, a biofuel. ADM was trading at the $39.83 per share level last week with a P/E ratio of 15.28. The company currently pays a 3.20% dividend. ADM traded to lows of $8.19 in September 2000 and highs of $53.91 in December 2014.

Deere & Co. (NYSE:DE) manufactures and distributes agriculture and turf, and construction and forestry equipment worldwide. Farmers need equipment to produce their crops and DE is a leading supplier of that equipment. DE was trading $77.74 last week with a P/E of 14.16. DE currently pays a dividend of 2.88% and it has traded in a range from $15.15 in March 2000 to $99.80 in April 2011.

We believe a balanced portfolio containing these three agricultural sector companies offers three things:

- The potential for capital growth given a lower than market average P/E on both a current and a historical basis.

- Dividend yields that are higher than the risk-free rate of return.

- An investment in the growth of agricultural demand, which is a function of global demographics.

Therefore, we rate these three companies the low-risk case in the commodity equity sector today, allowing investors to earn while they wait for capital appreciation, which could come quickly if agriculture returns to bull market conditions over the coming months.

A medium-risk approach – Crude Oil

Crude oil prices have recovered dramatically since February 11. While the future prospects for crude oil probably do not include a return price appreciation above the $100 per barrel level seen in 2014, there are signs that stabilization over $40 and potentially higher is in the cards. Crude oil was fast approaching the $50 per barrel level last week. Natural gas continues to languish at the $2 per MMBtu level but inventory injections have slowed this spring as producers are not making profits at current prices. Over time, production output should slow and inventories will decline on a commensurate level with lower production, causing prices to eventually rise and providing profitable opportunities for low-cost producers as they naturally build market share from attrition in the industry.

BP (NYSE:BP) is an integrated oil and gas company involved in all aspects of the energy business on a worldwide basis. Over recent years, BP faced problems related to a massive oil spill in the Gulf of Mexico. However, the liabilities for that situation appear to be behind BP, and it has proper levels of financial reserves.

BP was trading at $31.93 last week with a negative P/E ratio. It pays a dividend of 7.45% – we rate this company as a medium-risk approach to the energy sector as the dividend compensates for the lack of earnings. We believe that the worst is in the past for BP and the prospects for the oil market have improved. While production is increasing in Iran, Saudi Arabia, Libya, and Iraq, it has fallen below 9 million barrels per day in the U.S. Production in Canada, Nigeria and Venezuela has decreased for a variety of reasons and there are signs that Russian production will move lower. The oil price likely overshot to the downside in February and the current price between $40 and $50 per barrel represents fair value for oil.

A high-risk approach – The 800 pound gorilla and others

The high risk approach to the commodities sector boils down to a bull bet on China. As the world’s largest and most influential consumer of raw materials because of both population and economic growth, China is the 800 pound gorilla in the commodities sector. There are three companies that will explode higher if the Chinese economy recovers and growth exceeds market expectations. The downturn in commodity prices has not been kind to the major mining and trading companies, but if prices can sustain recent gains, we could see a dramatic improvement for the prospects for these companies and a requisite rebound in their share prices.

Glencore (OTCPK:GLNCY) is a diversified trader and producer of commodities as a result of its merger with global commodity producer Xstrata. It is an active trader and producer of metals, minerals, energy and agricultural products. Glencore is involved in all aspects of these businesses from production to processing, refining, transport, storage, marketing and distribution. It has a negative P/E, but the company has been actively cutting debt, recently selling off 40% of its agricultural business to a Canadian pension fund. Glencore is the 800 pound gorilla when it comes to trading acumen. The company pays a 9.29% dividend to compensate for the current lack of earnings. GLNCY shares have traded in a range between $1.95 per share in January 2016 to highs of $15.70 in February 2012 just following the company’s IPO in May 2011. The company’s merger with Xstrata in 2012/2013 resulted in a mountain of debt, which the company is now working to lower. GLNCY shares were at $3.665 last week. This company has a high-risk, high-reward profile.

BHP Billiton (NYSE:BHP) is a diversified commodity producer with production interests all over the world. BHP was trading at $26.84 per share last week. The recent bear market in commodities has caused the company to have a negative P/E ratio. To compensate for its lack of earnings, BHP currently pays a 5.51% dividend. Shares of BHP have traded from lows of $7.56 in September 2001 to highs of $104.59 in April 2011 at the height of the bull market in commodities. Any improvement in the Chinese economy will have an immediate effect on BHP shares, which are in some ways a proxy for Chinese and global economic growth that will boost raw material prices.

Finally, Rio Tinto (NYSE:RIO) is a massive metals and mining company with production interests around the globe. RIO shares were at $28.31 last week. The company has a negative P/E due to the bear market conditions that have persisted over the past five years for the commodities they produce.

RIO pays a dividend of 7.25%. In September 2001, it traded to lows of $13.43, and highs of $139.66 in May 2008. Like BHP, RIO is a proxy for Chinese growth as the nation consumes vast amounts of metals and minerals to build infrastructure and support a population of over 1.3 billion people. The potential for growth in coming years from the world’s second-most populous nation, India, provides additional potential for infrastructure demand, which will boost returns for BHP and RIO as well as GLNCY.

The high-risk cases for investments in the commodity sector are based on better-than-expected growth in Asia over the coming months and years. While their shares have suffered over recent months, a turn in the trajectory of the commodity asset class is promising for these high-risk companies.

Yield and capital growth are only available at the beginning of a market cycle

All of the stocks mentioned in this piece have negative price to earnings ratios or P/Es that are not only below the current market average but below the long-term average of 16. They all pay dividends that are above market averages, and in the case of those companies with negative P/Es, the dividend yield compensates investors for the added risk in the current environment.

The potential for both yield and capital growth is compelling and rare, and it tends only to be available at the beginning of a new market cycle or a shift in a long-term trend. We believe that commodities put in important lows in late 2015 and early 2016. There will be many factors that influence commodity prices over the weeks and months ahead. A rally in the dollar could cause prices to fall; however, it is unlikely that we will see the lows that were established several months ago. Therefore, we would suggest using weakness in commodity prices to buy these companies slowly on a scale down basis to build a balanced portfolio of commodity investments for the years to come.

Robyn Conti and I will be on my biweekly radio show, The Commodities Hour, on Tuesday, May 25 to discuss these compelling opportunities as well as other issues in her area of expertise, dividends and investing. You can tune in to the show on Tiger Financial News Network that will air at 5 PM EST here. And, you will get to see Robyn live so do not forget to be there.

SOURCE: SeekingAlpha.com